If you’re a first-time homebuyer, you’re not alone in feeling that buying a home today comes with some big challenges. With home prices and interest rates on the rise, affordability is a major concern. But don’t worry, there are solutions that can help, and FHA loans are one of the most popular options for buyers who are just getting started.

What Is an FHA Loan and How Can It Help First-Time Buyers?

An FHA loan is a mortgage option backed by the Federal Housing Administration. It’s designed to make homeownership more accessible, especially for people buying their first home. These loans offer features that can help you get into a home with less money upfront and more manageable monthly payments.

Whether you’re hoping to stop renting, settle down in a place of your own, or simply take that exciting step toward homeownership, an FHA loan might be a good fit.

Why Buying Your First Home Feels Hard Right Now

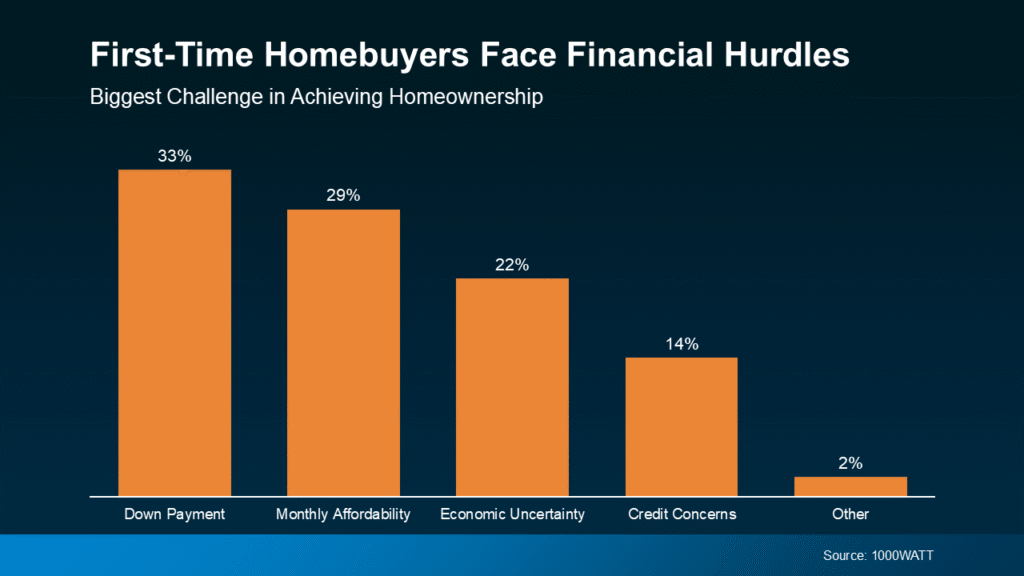

Affording a home can feel difficult, especially for first-time buyers. A recent survey by 1000WATT found that the two biggest concerns for people entering the housing market are:

- Saving enough for a down payment

- Being able to afford the monthly mortgage payments

These are real concerns, but this is exactly where FHA loans can step in to make a difference.

FHA Loans Offer Lower Down Payment Requirements

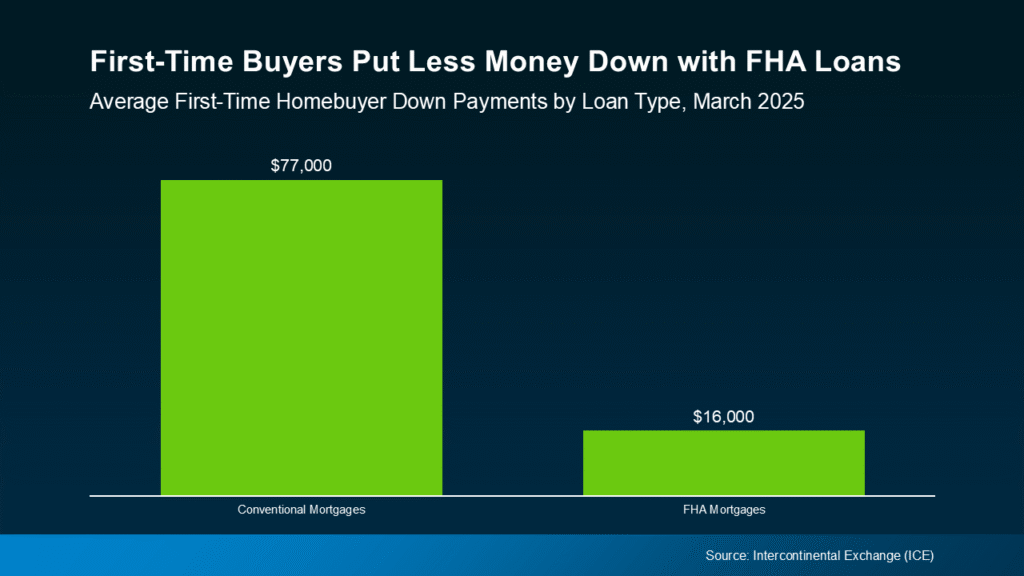

One of the main benefits of FHA loans for first-time homebuyers is the low down payment requirement. According to data from Intercontinental Exchange (ICE), the average first-time buyer using an FHA loan puts down significantly less than the average down payment for a conventional loan.

With an FHA loan, buyers often don’t need to come up with as much cash upfront. This can make the goal of buying a home more realistic, especially if you’re still building your savings.

FHA Loans May Also Offer Lower Monthly Payments

In addition to lower down payments, FHA loans often come with competitive mortgage rates. In fact, Bankrate notes that rates for FHA loans are often slightly lower than those for conventional loans. That can mean smaller monthly payments, which helps ease one of the biggest concerns buyers face today.

How to Get Started With an FHA Loan

If you’re a first-time buyer wondering how to afford a home, talking with a trusted lender is a smart move. They can explain the FHA loan requirements, walk you through the application process, and help you compare your options. You’ll get a clearer idea of what you can afford and how to move forward with confidence.

Conclusion: FHA Loans Make Homeownership More Accessible

Buying your first home doesn’t have to feel out of reach. FHA loans are designed to support first-time buyers by reducing upfront costs and potentially lowering monthly payments. With the right loan and professional guidance, your path to homeownership could be closer than you think.

Ready to explore your options? Contact us and we’ll put you in touch with one of our dedicated loan officers, who can help you understand if an FHA loan is right for you.

Source: Keeping Current Matters

Start The Journey to Homeownership Today!

So you’re thinking about purchasing your first home — congratulations! That’s a big decision, but don’t stress. Jet Direct Mortgage is here to help walk you through every step of the home buying journey as quickly and efficiently as possible. So you can spend less time worrying about your loan and more time focusing on your dream home..

Download our “First Time Homebuyer” Guide!

Experienced Chief Operating Officer with a 26 + year demonstrated history of working in the banking industry. Skilled in all aspects of the residential mortgage market . Strong business development professional with a Bachelor of Science (BS) focused in Business Administration and Management, from St. Joseph College. A direct endorsement underwriter and a licensed Mortgage Loan Originator.